Spending a lot of time on shopping websites is, for me, an occupational hazard. Questions of consumerism are central to my job on a lot of levels, and both the joys and limitations of shopping as a hobby come up frequently while writing and researching. Lately, there’s been one notable phenomenon in the research phase of my day: an increasing number of brands and retailers are now offering their own third-party financing options, like small personal loans for your closet—no credit card required.

The first such company I ever saw offering this service was Affirm, which I started noticing on e-commerce sites over a year ago. According to Racked, the service is exactly what its presence on high-end clothing retailers would make it seem like: a relatively new microloan business, doling out small personal loans for everything from plane tickets to fancy jeans. The company has been around since 2012, but only relatively recently has it become more visible across fashion sites.

Affirm recently started offering 0% APR with select retailers, but in general, its interest rates range between 10% and 30%, depending on your credit score, similar to many credit cards. Payments on Affirm loans are made monthly, with fees for missing a payment, just like most traditional credit sources. The difference is that you get approved or denied immediately, at the point of sale—it’s like if stores gave out credit cards with limits set for only the thing you already have in your hands.

Yesterday, while researching a different story, I came across one of Affirm’s apparent competitors for the first time: Afterpay, which is an Australian financial technology company whose service works a little differently than Affirm or the credit cards and personal loans that came before it. If a site offers Afterpay, you can split a purchase between $35 and $1,000 into four payments, automatically deducted from your bank account every two weeks, which seems to assume the purchaser gets a paycheck every two weeks. As long as those payments are made, there’s no interest charged, but late payments incur an $8 fee.

Affirm has confused me since I became aware of it, because it doesn’t function substantially differently than any of the credit cards I already have—wouldn’t someone who can get approved for a personal loan also have decent enough credit to have a card that functions under similar terms? Wouldn’t simply using that existing credit be better for your credit score than opening a new line that requires an inquiry to the credit bureaus? Maybe it’s just a psychological thing that doesn’t appeal to me: having the debt in a separate place and knowing it will be paid off diligently and in a set amount of time might be comforting to some people.

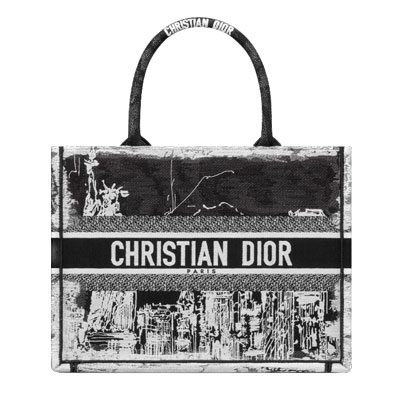

On the other hand, I totally get Afterpay—what if you spot the bag of your dreams on sale before you’ve fully saved up the purchase price? The promise of no interest and the short timeframe to be done with the payments make it a more appealing option for me, because the fact that you took out a personal loan and with it you bought shoes (because of the $1,000 cap, most designer handbags would be out of its range) isn’t hanging over your head for like a year. It would only work if you had regular paychecks, but without them, paying monthly payments to any other creditor might be tricky anyway.

Still, though, I’d feel a little weird using any kind of personal loan service just to buy something fun and unnecessary. I was a little less mindful of these things in my mid-20s, and I’m still paying off the last of those youthful credit card indiscretions, which is a process that has taught me a lot about, well, not buying things I don’t have the money to pay for right now.

At the same time, designers are moving to make their most compelling pieces ever more elusive in order to urge shoppers to buy at full price, and sometimes the heart wants what the heart wants, and what the heart wants will be sold out by the time the budgetary math catches up. So we want to hear from you: Would you finance a bag, with one of these services or some other way? Have you?