I wrote this article back in 2018 “Can your next Chanel bag make you money? Looking at designer bags as alternative investments“, which continues to be my most popular article I’ve ever written on Medium. I am not surprised because this topic continues to both fascinate and divide people. You often hear about luxury influencers and YouTubers talking about their designer bags as “investments” and the luxury community is so divided on this topic with one side saying no they are not while the other says they are, indeed.

I understand. It may not be an “investment” in the most traditional sense in that bags are meant to be loved and used (could there be a bias in that because it’s women investing and empowering ourselves and building wealth? That’s a whole other topic for another day).

What if I told you that they are actually a savvy investment option you should consider? It’s a tangible asset that you can collect, use for many, many years, and sell for significant profit?

Making the case for Chanel bags as sensible investments

Side note: I’ve actually sold some bags recently to further curate my closet. In fact, two of my vintage Chanel bags were sold way above the price I paid for them and I walked away not only getting the best cost per wear since I wore them for quite some time but also made extra cash that I can invest into other bags or put in my investment accounts. I also see my collection as part of my investment portfolio, providing extra financial security.

We are experiencing an uncertain economic climate right now with the rising living costs, inflation, and now the talk of a recession. All the while household debt continues to climb and wages remain stagnant. Some say cash is king, others say cash can lose its value with the ups and downs in the global economy.

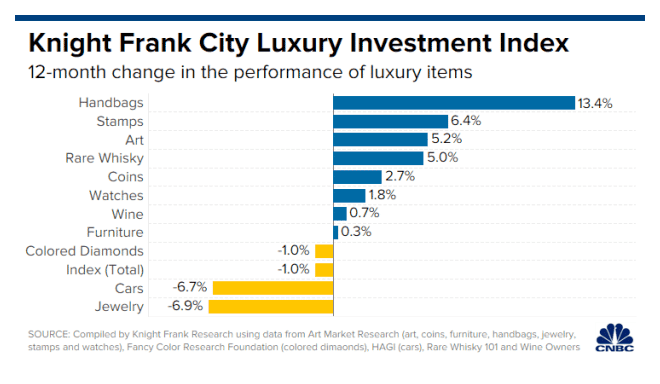

It is all about diversification, and I am here to tell you that: YES you should invest in real estate, YES you should invest in the stock market and bonds and YES you need to invest and prepare for your financial future. But investments aren’t just typically what you think of; in fact, there are many alternative investments such as vintage cars, fine art, wine, and luxury goods that not only hold their value but also continue to grow in their value. And guess what? Luxury handbags are one of those categories that continues to outperform other traditional collectibles.

By their correlations, most collectibles offer diversification to traditional financial assets such as bonds and equities – Deloitte

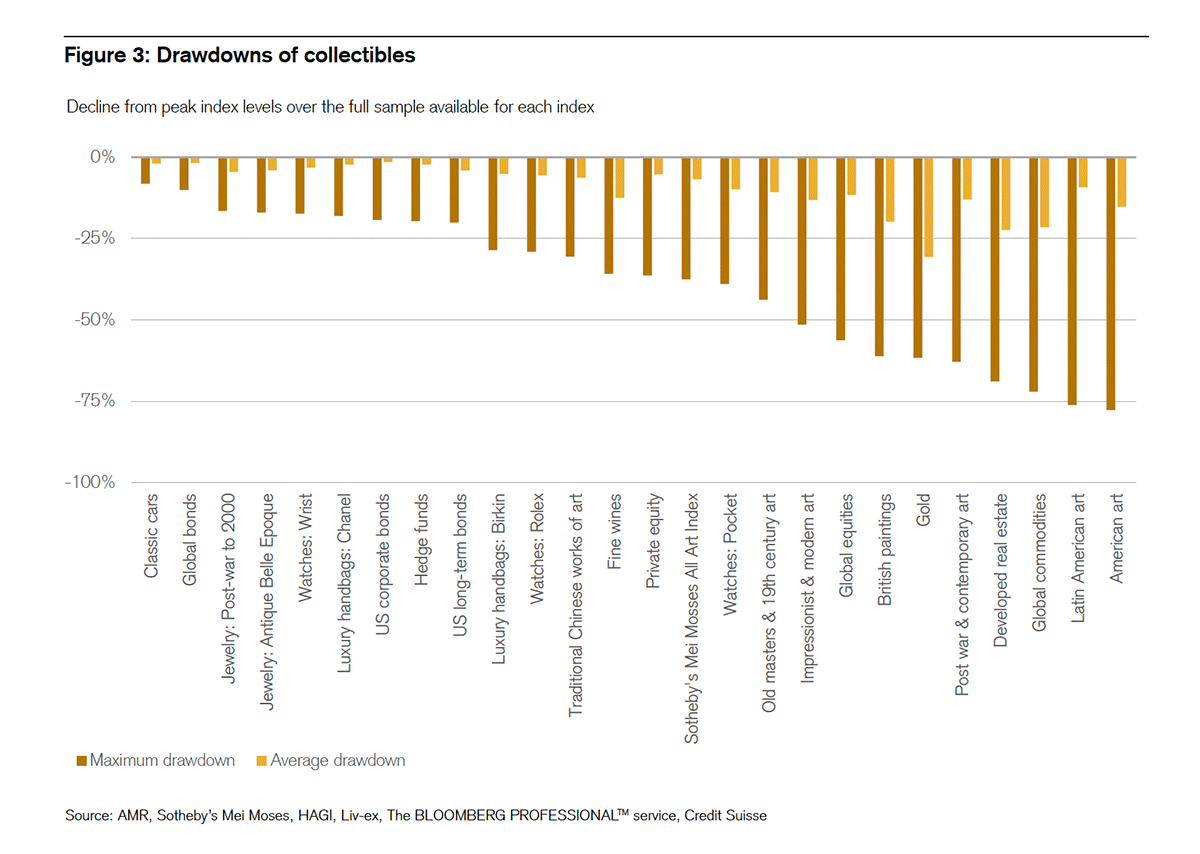

Don’t just take my word for it. The latest collectibles report by Credit Suisse Deloitte proves what I’ve been saying for years and here are the top three highlights:

1. Chanel bags are better financial assets with strong demand

Lagerfeld-designed Chanel handbags are likely to continue benefiting from the scarcity effect in the next few years, in our view, but the brand’s broader evolution in luxury handbags will be determined by the ability to sustain collectors’ excitement going forward. Hermès Birkin bags, in contrast to Chanel bags, have had higher volatility, more comparable to that of global bonds or hedge funds among financial assets, but a better risk-reward than the latter.

Another side note on that: Hermès Birkin bags have actually outperformed the stock market and gold in the past. As a matter of fact, this CNBC article states that handbags were better investments than other asset classes.

2. Luxury handbags have low volatility, hence providing more stability for investors

Watches and jewelry as well as handbags (especially Chanel handbags) are clearly standing out as stores of value with low volatility (between 2.5% and 5% annually) and low drawdowns. With the exception of pocket watches, their annual returns are 4.5% – 6.5%. Their information ratio (which puts returns in relation to volatility and is thus reflective of the risk-reward) is impressive, with values exceeding 100%, i.e. average returns systematically outpacing fluctuation ranges. Particularly noteworthy are Rolex watches and Chanel handbags, with very strong information ratios of 200% or higher. This means that the average annual return of 10% for Rolex watches for example is double the usual fluctuation range of 5%.

Especially in the current volatile market we are in, low volatility sounds pretty good to me!

3. Chanel bags can protect you from inflation and give you extra financial security during recession

As 2022 is marked by a transition to a more elevated inflation regime and higher interest rates, it is relevant to evaluate the sensitivity of the various collectibles to inflation and interest rates (see Figures 4 and 5). The best inflation protection (as measured by performance in extreme inflation periods) is offered by Chanel handbags, followed by traditional Chinese works of art and wristwatches, in particular Rolex. Most vulnerable to more elevated inflation regimes are fine wines, and American and Latin American art. Conversely, classic cars and post war & contemporary art do best in low or normal inflation times. Rolex watches appear to be the ideal inflation all-weather stores of value.

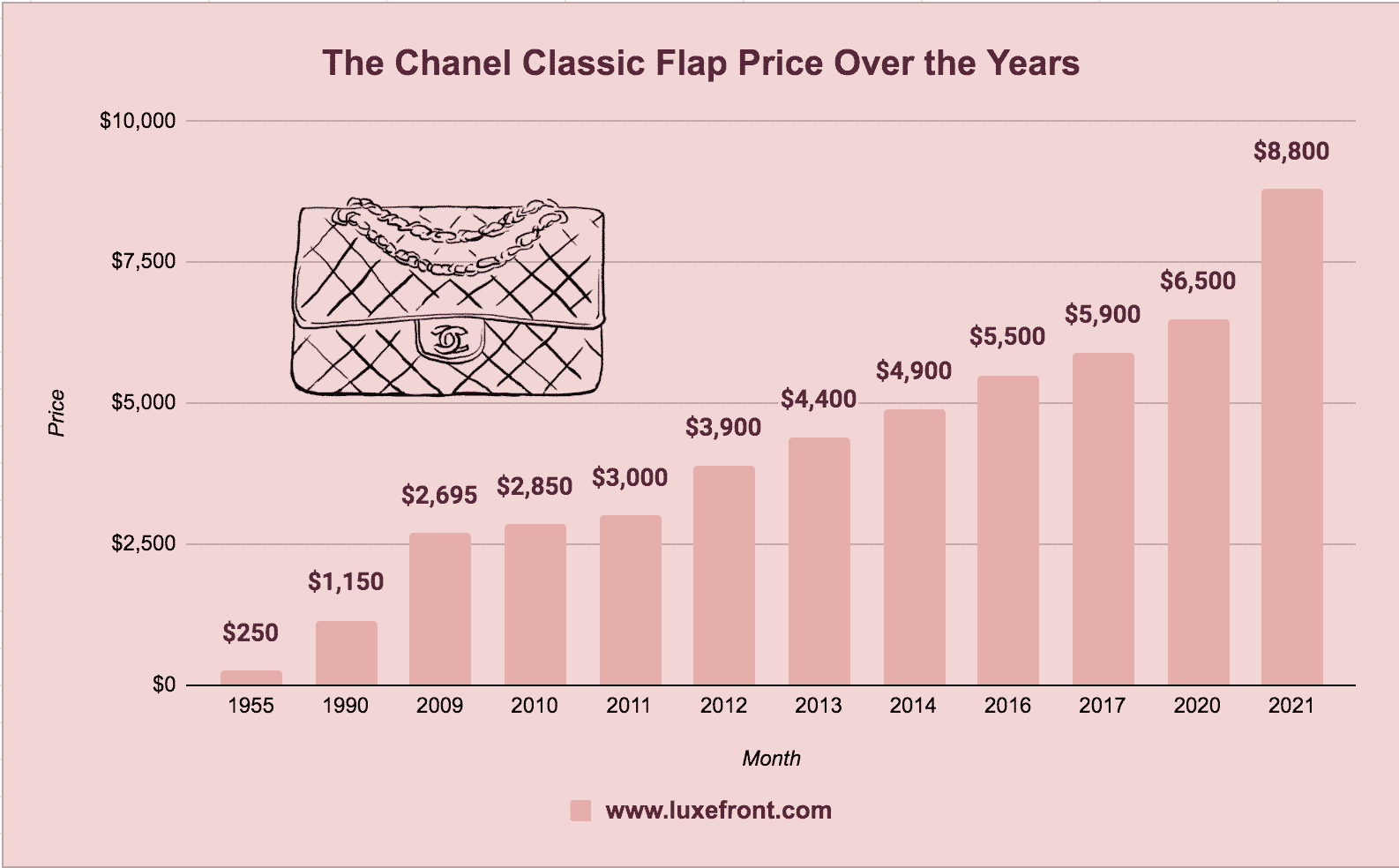

What is driving this growth and its impact on the resale market: Chanel’s pricing strategy is primarily contributing to their exponential growth. Chanel has had multiple price increases in recent years; in fact, since 2020, Chanel’s prices have gone up more than 35% for their Medium Classic Flap.

There will always be people who can afford these bags no matter how much Chanel charges them (pretty soon, the Medium flap will likely surpass Hermes Birkin prices…). However, for most of us, this is causing us to look into the resale market to get our hands on Chanel bags, whether they are preloved or vintage. In fact, when you look on Fashionphile, Yoogi’s Closet or Rebag, you can find Chanel bags for 30-50% off the retail, depending on the condition and size.

Not only that, the recent surge in popularity in Vintage Chanel bags is also driving up the prices for bags that are 20-30 years old.

make for the best investments…

Case in point, I remember purchasing my Vintage Jumbo XL flap for $2,000 in 2018 and now it is $6,000+. Forbes also reported earlier this year that one of the leading consignment stores, Fashionphile, reported $500M in sales. In fact, Bain estimates that the luxury resale market is estimated to be valued at more than $33 billion. It is estimated this market will surpass $52 billion in the next five years.

With the growing demand and limited supply and access to classic Chanel bags, this will only drive the prices in the resale market. Now is the time to get your Chanel bags. Soon, could it be possible that the resale market for Chanel may mirror that of Hermes in which the prices exceed the retail price?

Investments are personal and often emotional choices. Let’s not judge each other on how we choose to spend our hard-earned money.

Ladies (and gentlemen), let’s empower ourselves by building our wealth one step at a time.

Cheers!