I am starting off this article with an expression of deep and genuine gratitude to the kind (and funny!) tPFer @duggi, who not only sent me a link to the Hermès 2020 Universal Registration Document (including its annual Financial Year Report) (all of which I am calling “The Report” for ease and clarity) and suggested that I write about it, he also started a wonderful and interesting TPF thread summarizing it. Because his work is the original, I am linking it here. Any paraphrasing or similar wording presented in this article is unintentional (and has his express permission, anyway, because there’s only so many ways you can say something).

Summary of Hermès 2020

The Report starts off with highlights of the year. The story seems to be that the first half of Hermès’ Financial Year was terrible, with recovery starting in the second half of the year and gaining steam by the 4th quarter. A strong recovery is well underway due to the large gains at the end of the year. Overall worldwide sales were down, though relatively minimally.

Consolidated revenue reached €6,389 million (or … €6,389,000,000. I think using the term “million” is confusing when it’s actually 6 billion plus.). This was down 6-7% over 2019, presumably due to the pandemic. Sales recovered in the second half of 2020, with sales in the 4th quarter up 16%. The revenue generated for the year overall was down only 2%, with 4th quarter revenue up 21%. Of note, “wholesale activities” were down by a whopping 32%, and the context indicates this was largely due to the drop-off of airport duty-free sales (no surprise there, except one might think it could have been even worse!).

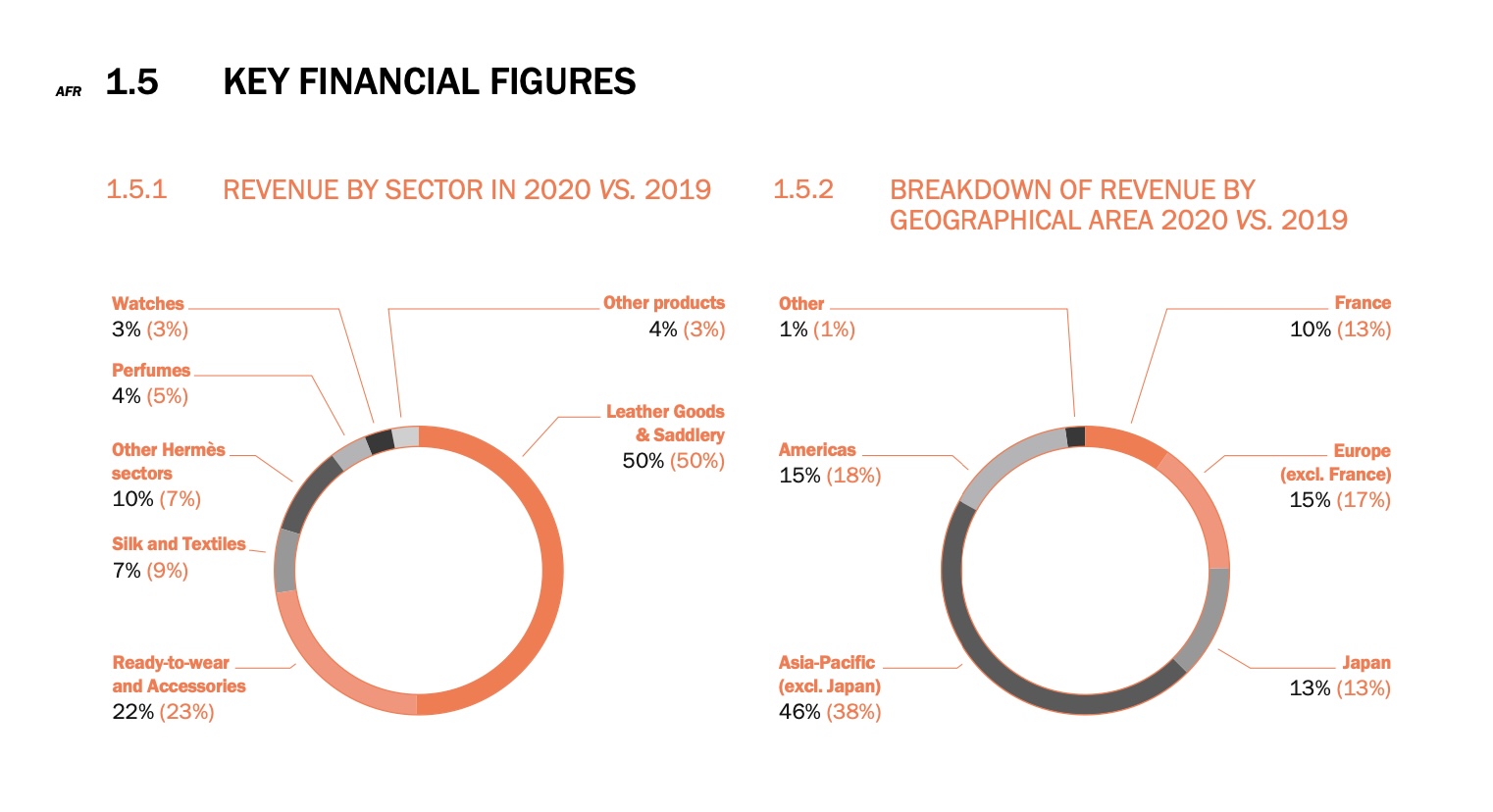

By region:

- Asia sales (excluding Japan, and most specifically Greater China, Korea and Australia) were by far the strongest, up 14% for 2020 (which includes growth by an incredible 47% in the 4th quarter alone), and were fairly strong through the 2nd half of the year, both in stores and online.

All other regions were hit due to the pandemic:

- Japan’s sales decreased -4%

- America -21% (although it did grow slightly in the 4th quarter)

- Europe excluding France -20%

- France -29%

This was all due mainly to lockdowns, store shutdowns and lack of tourism.

By métier:

- Leather Goods and Saddlery was -5% for 2020, but again +18% in the 4th quarter. Two production shops will be opening in 2021, another in 2022, a fourth in 2023 and yet a fifth in 2024. All of these sites will be in France.

- RTW and Accessories -9% (+12% in the 4th quarter).

- Silk and Textiles -23% and Perfumes and Beauty -19%, again due to lack of travel and tourism.

- Watches +2% for the year (+28% in the 4th quarter).

- The remaining departments were consolidated and +28% (+56% in the 4th quarter), mainly due to the success of the Home and Jewelry departments.

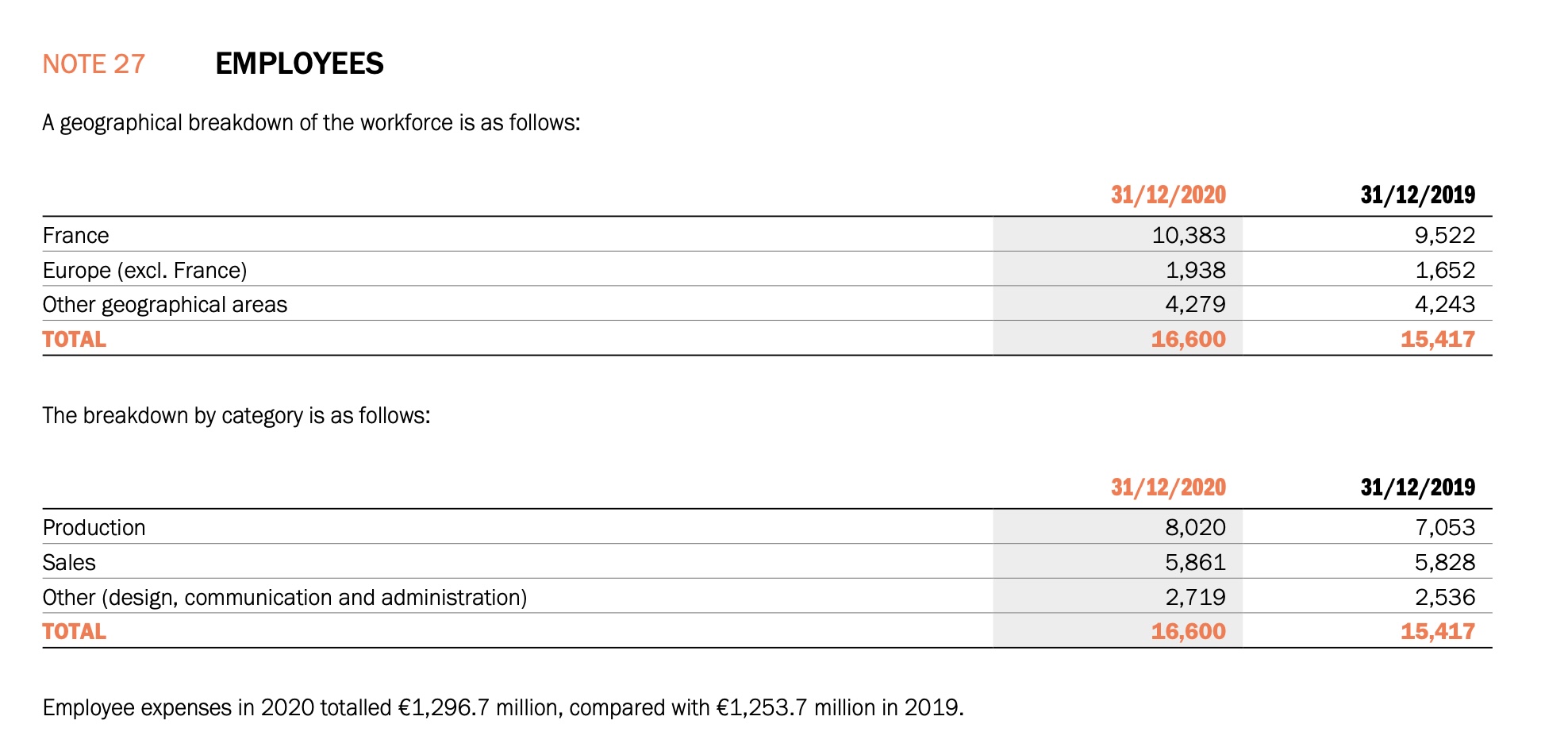

In 2020 Hermès grew its workforce by 1,183 people, most of that growth coming from the purchase of one of its suppliers. Jobs and salaries were maintained, with a €1,250 bonus to be given to all group employees in 2021.

What follows next are overviews of the history of Hermès; its governance; strategy (creation; craftsmanship; vertical integration of materials; its exclusive distribution network specifically tailored to each sales outlet [whether boutique or website] and aimed at fostering its relationships with customers and enhancing their experiences with the brand; entrepreneurial spirit [individual boutique autonomy with regards to inventory and purchases at the biannual podium]; independence, both economic and financial; and responsible growth); an organization chart; real estate; and the financial charts.

Now we get to the good stuff: highlights from the various mètiers, starting with our favorite:

1.6.1 Leather Goods & Saddlery (page 26)

This includes all bags, briefcases, luggage, small leather goods, diaries and writing objects, saddles, bridles and all the equestrian items, including clothing. This mètier accounts for 50% of sales and in 2020 it “generated €3,209 million in revenue”.

1.6.1.1 Women’s Bags

The report highlighted new bag offerings in the women’s department, including the Della Cavalleria, the New Drag, the Chaîne d’Ancre bag and the Cabassellier; the latest iteration of the Birkin, the Birkin Cargo; bags that can be carried in a variety of ways, including the In the Loop, the Émile Hermès bag, and the small 24/24; a new evening bag, the Minuit au Faubourg, a new space-themed version of the Sac á Malice; and using new materials on or with established classics, such as hand-painted Birkins and Kellys, embroidery on the Roulis Mini, the Constance Marble Silk, and the Kellywood Bag, which includes both Oak and Barenia.

1.6.1.2 Men’s Bags (page 27)

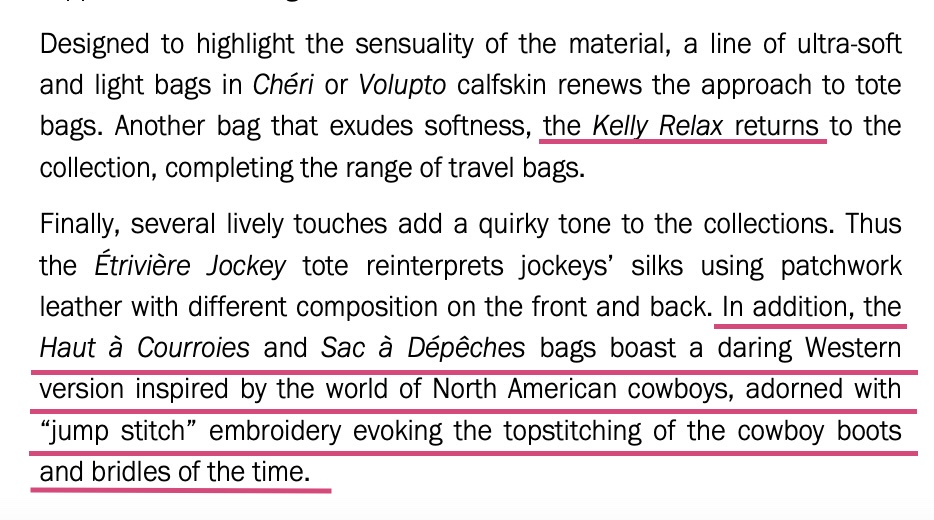

It also discusses an expansion of the men’s bag offerings, including a Steve Light Junior, a compact version of the Flash Messenger 29, and a Second Side bag, which is meant to be worn very close to the body (I imagine it will be great for subway travel). Emphasizing the use of light and supple leathers – and now this is the part where my heart truly flutters, because within this relatively sedate discussion on mens bags I read this:

So! It looks like we can expect the return of the Kelly Relax (even though I’m not into large bags, I’ve always really liked the proportions of the larger Kellys). Even more up my alley are these intriguing western-themed versions of the HAC and the Sac à Dépèches, which I personally CANNOT WAIT to see.

1.6.1.3 Accessories and Small Leather Goods

As for SLGs, the report briefly touches on the Constance and Kelly “To Go” and the Constance and Roulis Slim wallets; a Chaîne d’Ancre collection of items to be held on their own or attached to a strap; the Zipengo and the H-Tag lines; the Paddock Purse; the Carré Pocket; the Silky Pocket; bag charms which are miniaturized versions of other Hermès objects, such as the Oran Nano and Carré Nano; and the leather accessories meant to go with the items in the Beauty mètier.

1.6.1.4 Materials

Under this heading, the report mentions the new colors, such as Rose Mexico, Rose Texas, Bleu Brume, Foin, Vert Maquis, Sesame and Bleu Frida, newer printing techniques like Toile H en relief, new textiles like Casaque and Woolywooly, and a new leather called Dandy Calfskin for SLGs.

Then we skip over to –

1.6.2 Ready to Wear and Accessories (page 28)

“The Ready-to-wear and Accessories métier is the Hermès Group’s second largest sector, representing 22% of consolidated sales. In 2020, it generated €1,409 million in revenue.”

1.6.2.1 Women’s Ready to Wear

The theme for 2020 women’s ready-to-wear was an exploration of “modern femininity”. Womenswear designer Nadège Vanhée-Cybulski’s Spring/Summer line included useful details and traditional Hermès patterns and motifs. Utilizing fluid materials, the pieces were meant for “urban and everyday use”. The Fall/Winter line centered around the ideas of the themes of the suit, the outdoors and the kilt and focused on a slim, but comfortable and functional silhouette.

1.6.2.2 Men’s Ready to Wear

Reflecting the 2020 theme of innovation, Véronique Nichanian, Artistic Director of Hermès’ “Men’s Universe”, also utilized fluid materials for Spring/Summer, adding bits of color to the traditionally muted men’s palette. The Fall/Winter line was more divergent (the report calls it “radicalism”), with atypical plays on volume and color.

1.6.2.3 Fashion Accessories

1.6.2.3.1 Jewelry Accessories

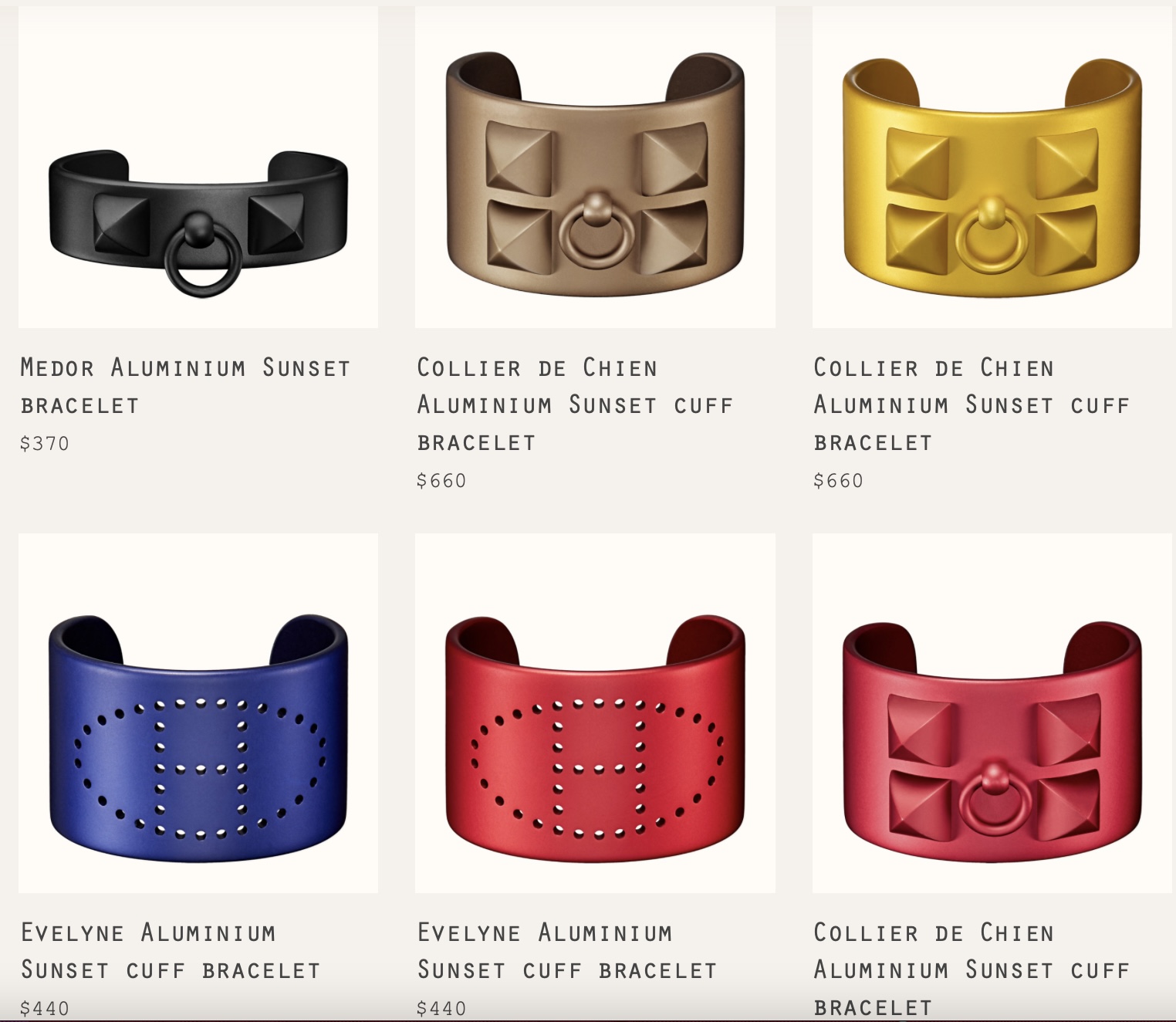

Highlights from the fashion jewelry department include the two aluminum cuffs, – one done with Médor studs like the Collier de Chien, and the other with the perforated H of the Evelyne, each produced in bold colors – and the Clic H enamel bracelet with the pattern continuing across the H closure. There were also new lines of leather and of horn jewelry, both based on equestrian themes.

1.6.2.3.2 Belts

New pieces in the women’s belt department included enamel buckles, new colors and designs (such as embroidery) for the straps, and the addition of pockets or studs. Men’s belts added a patterned strap and – this is news to me – a new mechanism which enables a buckle to accommodate both the 32mm and the 38mm straps.

1.6.2.3.5 The Internet of Things

2020 saw the addition of the Apple Watch Hermès Series 6, including the new Hermès Attelage model with a redesigned buckle, new strap colors, and added Hermès Circulaire dials for watch face customization.

1.6.2.3.6 Shoes

Pierre Hardy, who directs both the women’s and the men’s shoe métiers (as well as the fine jewellery collections), added jeweled heels (including rhinestones or lacquer) for women and new materials (mesh; transparent rubber; cord) for both women and men and an emphasis on rugged soles for the fall/winter season.

1.6.3 Silk and Textiles

This is the 3rd largest department for Hermès, accounting for 7% of sales, and generating €452 million in revenue in 2020.

1.6.3.1 Women’s Silk

“This year is truly a year of innovation for women’s silk, which marks the event with a major development in the history of silk: for the first time, Hermès presents a double-sided scarf printed differently on both sides. A technical achievement that required years of development in collaboration with the House’s printers in Lyon.”

Other highlights from women’s silk include the 3D Cavalcadour Voltigeur, Exposition Universelle, (both nods to the theme of innovation), the plain double-faced cashmere scarf with pockets, and a poncho with a Kelly Turnlock clasp.

1.6.3.2 Men’s Silk (page 30)

This section also highlighted the men’s double-sided offerings, such as C’est la Fête and Formule Chic. And again, more information that even I did not know:

“Innovation is also reflected in the Rêve hypnotique scarf. This motif is a “freeze frame” of a digital work, inspired by biology and composed of swirls of colours in motion. Projected in prestigious locations around the world, in the form of an immersive installation, this work was photographed, engraved and then printed in the Lyon workshops to become the classic carré scarf.”

The men’s silk department has continued to expand with success. Additionally, the ties utilized embossing (either Chaîne d’Ancre link or a stirrup), trompe-l’œil denim, and brushed silk with leather.

1.6.4 Other Sectors

These sectors include Fine Jewellery, Home Goods and Tableware, and account for 10% of the revenue, approximately €643 million for 2020.

Other interesting things to note from the Report

1.4.3 Distribution Network

There are 29 corporate boutiques and 7 concessionaires in the United States….the exact same number as there are in Japan (pages 21-22).

While there are 306 locations, 85 of them are concessionaires (sales locations which are not Hermès corporate boutiques). There are 16 concessionaires in France, 8 in South Korea, 7 in the US, 7 in Japan, 4 in Italy, 3 in Mainland China, 3 in Taiwan, 2 each in the UK and Switzerland, 1 each in Australia, Canada, Denmark (Copenhagen location), Malaysia, the Netherlands, Thailand, and Turkey. Concessionaires are the only sales points for Austria (both locations), Bahrain, Chile, Indonesia, Kazakhstan, Kuwait, Lebanon, Luxembourg, Norway, Qatar (2 locations), Panama, the Philippines, UAE (5 locations), and Vietnam (2 locations).

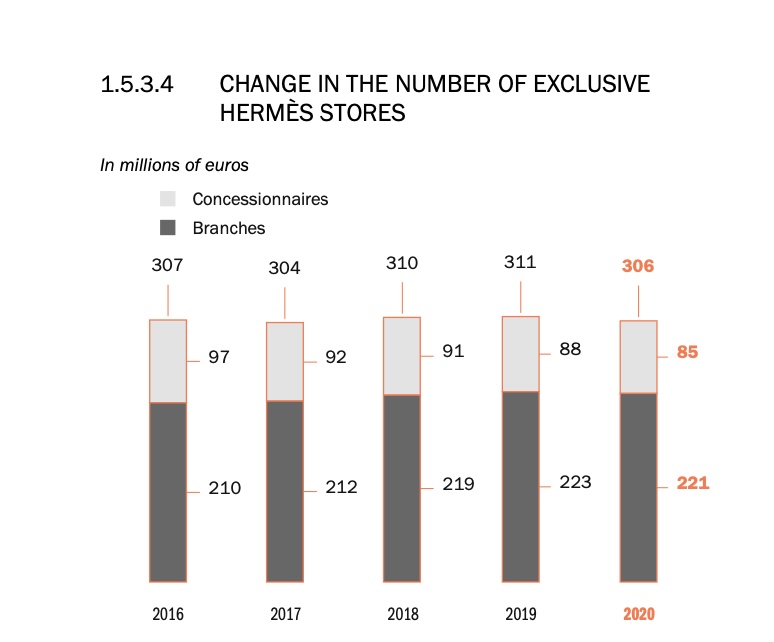

However, as has been discussed numerous times on PurseForum, these numbers reflect a decrease in the number of concessionaires proportionate to the number of corporate boutiques:

Section 2, pages 47-217 – the largest section of the report – deals entirely with Corporate Social Responsibility, regarding everything from employee development and well-being to partners and local communities, the planet, sustainability, and ethics.

- 2.4.1.3 Petit H operates based on available materials and involves all of the métiers. About 200 different pieces a year are one-of-a-kind, with a few hundred more items in very limited production (p.113)

- 2.4.1.1.4 There are more than 1000 different service lines. There were over 123,000 repair requests in 2020. There were 80,000 local (non-France) repairs; 29% of those were on leather goods and were handled by 33 leather craftspeople. (p.114)

- 2.4.1.1.5 “Hermès has set itself the objective of not destroying new products intended for sale, particularly for clothing, by 2022” (p.114)

- 2.4.2.2.1 Hermès uses more than 35 different kinds of leather. “The leathers used are 96% food by-products and 92% sourced in Europe” (p.118)

In addition to Hermès International, there are an additional 75 consolidated companies owned by Hermès. This includes companies organized by location, such as Hermès Canada, and companies which were purchased to produce certain métiers, like John Lobb (pages 396-397).

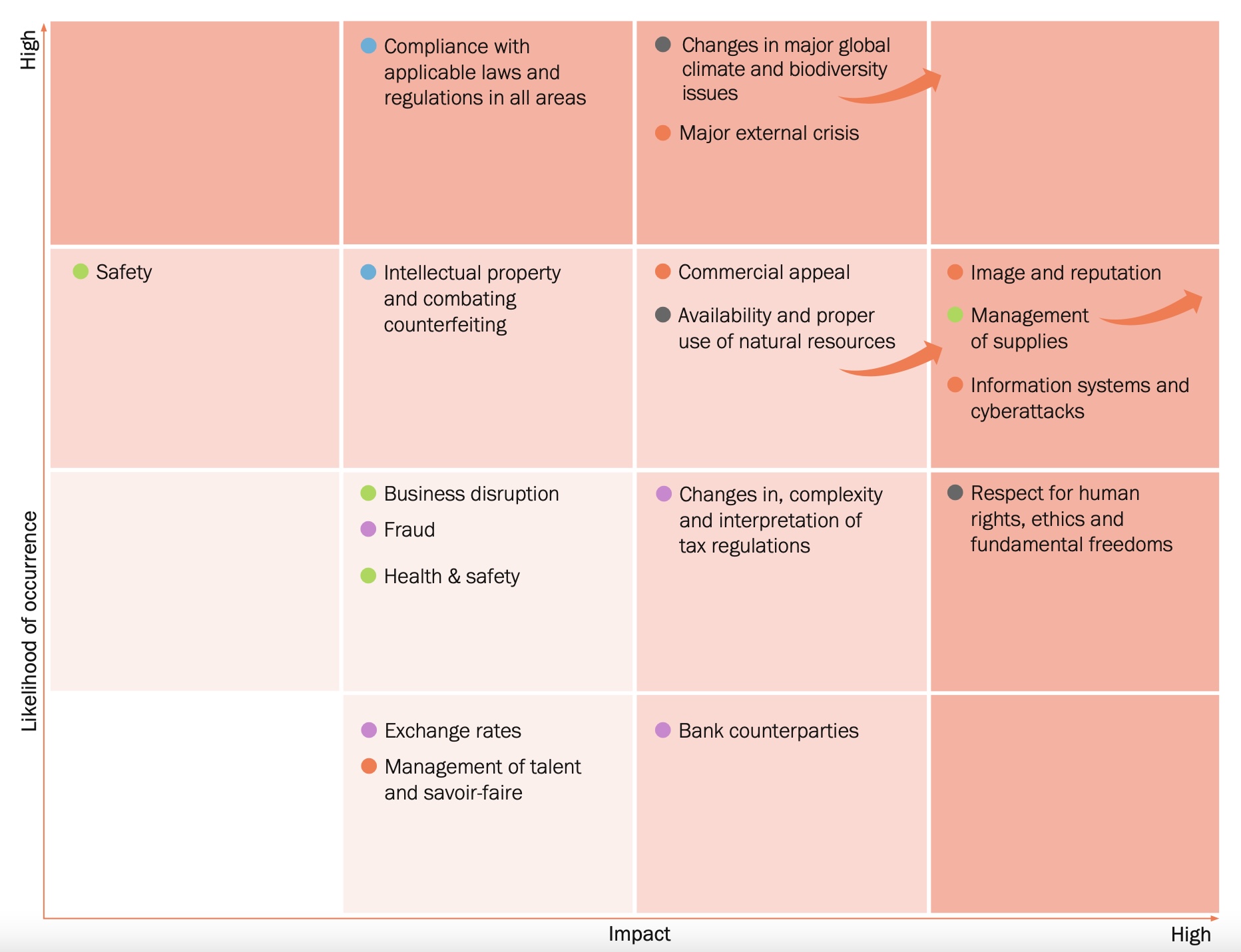

There is also an entire section based on “Risk and Control” (p.324-350)

My personal interest has always been the section dealing with intellectual property and counterfeiting issues, but of course commercial appeal and image/reputation are particularly applicable to PurseBlog. These were discussed here –

4.1.1 Risks related to strategy and operations

So basically we have a section here dedicated to two of Hermès’ chief risks: damage to its image/reputation and potential lack of commercial appeal.

With regard to the image issue, the risk management strategies are: employee documents (ethics charter, code of business conduct, anti-corruption code of conduct) and related training; unspecified methods (“systems”) of assuring related compliance from business partners and third parties; the importance of the management structure to maintain control; an online monitoring system; and a crisis management manual (page 326).

For its risks regarding commercial appeal and its potential effect on customer interest, I quote:

The commercial appeal and desirability of the products depend on the Group’s unique model, expressed through its radical style, the authenticity of its ancestral savoir-faire, primarily “Made in France”, the high quality of its products and services, its openness to local culture and its unrivaled communication. […]

In a constantly changing world, any failure of the Group to take customer expectations into account, issues with the quality of products or CSR concerns could negatively impact the House’s appeal.

The attractiveness of products could also be affected by the parallel market and networks of resellers offering a low-quality customer experience.

It seems like the main response to manage this risk relies on the creative teams and their production of the various collections, along with quality control, a support system for the craftspeople and suppliers, the in-store and online experience (both of these customer interaction points are mentioned but never specified beyond maintenance and regular renovation) and after-sales service (page 327).

I have to say – and as usual, this is my personal opinion – I think these risk responses are great but still wanting, due to the lack of any formal method of obtaining feedback. Beyond the occasional customer email (which is usually too specific to be generally useful), these modes of risk management are entirely insular. Unfortunately, it seems to me that it might be more efficient to have specific resources for feedback, which can help resolve issues that the corporate structure may not see in a timely fashion. I mean, how many times are customers blocked from the Hermès.com website, due to algorithms set in place which are meant to prevent reseller purchases, but instead make it easier for resellers (and much harder for genuine customers) to buy in-demand products online? How many times over the years have customers requested specific items – say, the reissue of a beloved scarf design – which never gets produced (and we wind up with the 10,000th version of Brides de Gala)?

The issue is not necessarily creating opportunities to criticize: I would think that a company so concerned with its relationships (the argument could be made that more pages of this report were spent delineating and describing its various relationships than on any other topic), would be open to a more collaborative opportunity with its customers: as an objective matter, is there any customer base more loyal, more passionate and better funded than Hermès’? Why not create a more communicative experience with the customers (a relationship at least as important as any other)? If the lines of communication were just a bit more open, I would be less inclined to see this portion of the risk management section as just a bit superficial. But maybe that’s just me.

For further information

Here is a link to the 2020 Universal Registration Document (the “Report”). Here is the Summary of the Report. Here is the March 2021 Letter to Shareholders, which also summarizes some of the information in the Report.